So, you’ve probably heard the term "PCE report" being thrown around in finance circles or during news broadcasts. But what exactly is it? Think of the PCE report as the economic pulse-checker for the United States. It’s like a doctor examining your heartbeat, but instead of your body, it’s the economy that’s under the microscope. This report gives us an inside look at how consumer spending is affecting inflation, which is a big deal for anyone keeping tabs on their money.

Here’s the deal: if you’re into investing, saving, or just plain curious about how the economy works, the PCE report is a must-know. It’s more than just numbers; it’s a snapshot of how people are spending their cash and what that means for the future. Whether you’re a stock market enthusiast or someone trying to make sense of rising prices, this report has got your back.

Now, don’t let the word "report" scare you off. Sure, it sounds all formal and boring, but trust me, it’s actually pretty interesting once you dive in. In this guide, we’ll break down everything you need to know about the PCE report in a way that’s easy to digest. So buckle up, because we’re about to take a deep dive into the world of economics!

Read also:Magazine Dreams Your Ultimate Guide To Living The Life Of Your Dreams

Before we get into the nitty-gritty, let’s talk about why the PCE report is such a big deal. It’s not just some random document that economists like to geek out over; it’s a key indicator of economic health. Think of it like a weather forecast for the economy. Just like you’d want to know if it’s going to rain or shine, businesses and investors want to know if the economy is heading towards a storm or clear skies.

What is the PCE Report?

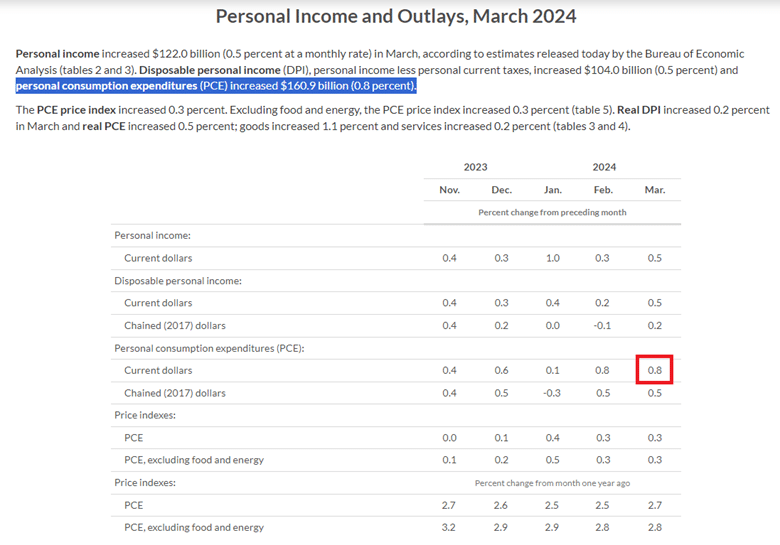

The Personal Consumption Expenditures (PCE) report is basically the government’s way of keeping track of how much people are spending on goods and services. It’s like a giant receipt for the entire nation. Issued by the Bureau of Economic Analysis (BEA), this report gives us a detailed look at consumer spending patterns and how they impact inflation.

Here’s the thing: the PCE report isn’t just about how much you spent on coffee last month. It’s a comprehensive breakdown of everything from groceries to healthcare. And why does this matter? Because consumer spending makes up a huge chunk of the U.S. economy. If people are spending more, it usually means the economy is doing well. But if spending drops, it could signal trouble ahead.

Why Should You Care About the PCE Report?

Let’s break it down. The PCE report affects everything from interest rates to stock prices. If you’ve got money invested in the market, you’ll want to keep an eye on this report. Here’s why:

- It’s a key indicator of inflation, which directly impacts purchasing power.

- The Federal Reserve uses it to make decisions about monetary policy.

- Businesses use it to forecast future sales and adjust their strategies.

Think of it like this: if the PCE report shows that inflation is rising too fast, the Fed might step in to raise interest rates. And that, my friend, can affect everything from your mortgage payments to your credit card bills.

How is the PCE Report Calculated?

Okay, so now that we know what the PCE report is, let’s talk about how it’s calculated. It’s not as simple as just adding up everyone’s receipts. The BEA uses a complex formula that takes into account a wide range of factors, including:

Read also:2024 Tax Brackets What You Need To Know About Your Money

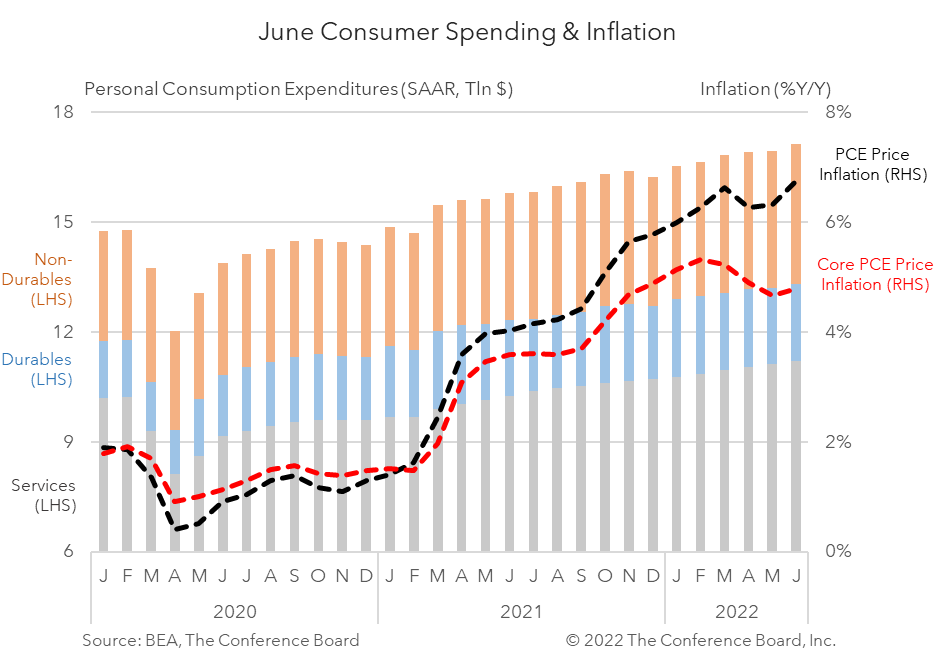

- Consumer spending on durable goods (like cars and appliances).

- Non-durable goods (think food and clothing).

- Services (everything from healthcare to haircuts).

What makes the PCE report unique is that it adjusts for changes in consumer behavior. For example, if the price of beef goes up and people start buying more chicken instead, the report will reflect that shift. It’s like a living, breathing snapshot of how people are spending their money.

Core PCE vs. Overall PCE

Now, here’s where things get interesting. There are actually two types of PCE reports: core and overall. The overall PCE includes everything, even volatile items like food and energy prices. But the core PCE strips those out to give a clearer picture of underlying inflation trends.

Why does this matter? Because food and energy prices can fluctuate a lot from month to month. By focusing on the core PCE, economists can get a better sense of whether inflation is really ticking up or if it’s just a temporary blip.

How Often is the PCE Report Released?

The PCE report comes out once a month, usually around the end of the first full week after the month it’s reporting on. So, for example, the report for January would be released in early February. This gives economists and investors a regular update on how the economy is faring.

But here’s the thing: the initial report is just the first look. It’s subject to revisions as more data comes in. So don’t be surprised if the numbers change a bit in subsequent reports. It’s all part of the process!

What to Look for in the PCE Report

When you’re reading the PCE report, there are a few key things to keep an eye on:

- Changes in consumer spending: Is it going up or down?

- Inflation trends: Are prices rising faster than expected?

- Core PCE: What’s happening with underlying inflation?

These metrics can give you a pretty good idea of where the economy is headed. And if you’re an investor, they can help you make informed decisions about where to put your money.

Impact of the PCE Report on the Economy

Now, let’s talk about the big picture. The PCE report doesn’t just sit there on a shelf collecting dust. It has real-world implications that affect everyone, from everyday consumers to big-time investors. Here’s how:

First off, the Federal Reserve uses the PCE report to guide its monetary policy. If inflation is too high, they might raise interest rates to cool things down. If it’s too low, they might lower rates to stimulate spending. And that, my friends, can have a ripple effect throughout the economy.

For businesses, the PCE report is a goldmine of information. It helps them forecast future sales and adjust their pricing strategies. If the report shows that people are spending more on travel, for example, airlines might decide to add more flights. If it shows a drop in retail spending, stores might offer more discounts to bring customers back in.

How the PCE Report Affects You

But what about you, the average Joe or Jane? How does the PCE report impact your daily life? Well, if you’ve got a mortgage or a car loan, changes in interest rates can affect your monthly payments. If you’re saving for retirement, the performance of the stock market can impact your portfolio. And if you’re just trying to make ends meet, knowing how inflation is affecting prices can help you budget more effectively.

So even if you’re not an economist or a stock trader, the PCE report still matters. It’s like a roadmap for navigating the economic landscape.

Common Misconceptions About the PCE Report

There are a few myths floating around about the PCE report that we need to clear up. First off, some people think it’s just another boring government document. Wrong! It’s actually one of the most important economic indicators out there.

Another misconception is that the PCE report only matters to big investors. Not true! As we’ve already discussed, it affects everyone in one way or another. Whether you’re buying a house, planning a vacation, or just trying to stick to a budget, the PCE report can provide valuable insights.

Why the PCE Report is Better Than CPI

One question that often comes up is: why use the PCE report instead of the Consumer Price Index (CPI)? Both are measures of inflation, but they have some key differences. The PCE report is considered more comprehensive because it includes a wider range of spending categories. It also adjusts for changes in consumer behavior, which the CPI doesn’t always do.

So while the CPI might give you a snapshot of prices at a specific point in time, the PCE report gives you a more complete picture of how the economy is evolving.

How to Analyze the PCE Report

Alright, so you’ve got your hands on the latest PCE report. Now what? Here’s how to break it down:

Start by looking at the overall trend. Is consumer spending increasing or decreasing? Next, check out the inflation numbers. Are prices rising faster than expected? Finally, take a look at the core PCE to see what’s happening with underlying inflation.

But here’s the kicker: don’t just focus on one month’s data. Look at the bigger picture. Are these trends consistent over time, or are they just a blip on the radar? By analyzing the report in context, you can get a better sense of where the economy is headed.

Tips for Reading the PCE Report

Here are a few tips to keep in mind when reading the PCE report:

- Focus on the big picture trends, not just the monthly numbers.

- Compare the report to previous months to spot patterns.

- Pay attention to any revisions to previous data.

By keeping these tips in mind, you’ll be able to make more informed decisions based on the information in the report.

Conclusion: Why the PCE Report Matters

So there you have it, folks. The PCE report might sound like just another dry economic document, but it’s actually a vital tool for understanding the economy. Whether you’re an investor, a business owner, or just someone trying to make sense of the world, this report can provide valuable insights.

Remember, the key is to look at the bigger picture. Don’t get bogged down in the monthly numbers; focus on the trends and what they mean for the future. And don’t forget to keep an eye on the core PCE, because that’s where the real story lies.

So next time you hear about the PCE report in the news, don’t tune it out. Take a closer look and see what it’s telling you. Who knows? It might just help you make smarter financial decisions.

And hey, if you found this guide helpful, why not share it with your friends? Or leave a comment and let us know what you think. The more we talk about these things, the better we all become at navigating the economic landscape. So go ahead, spread the word!

Table of Contents

- What is the PCE Report?

- Why Should You Care About the PCE Report?

- How is the PCE Report Calculated?

- Core PCE vs. Overall PCE

- How Often is the PCE Report Released?

- What to Look for in the PCE Report

- Impact of the PCE Report on the Economy

- Common Misconceptions About the PCE Report

- Why the PCE Report is Better Than CPI

- How to Analyze the PCE Report